Transcribed from This is Hell! Radio’s 4 October 2014 episode and printed with permission. Edited for space and readability. Listen to the full interview:

“If the Department of Education is operating mostly like a debt collector it’s going to think mostly like a debt collector rather than somebody that supervises an education system.”

Chuck Mertz: The college school year has begun. What better time to tell incoming and returning students that university education can be a scam? And now the Too Big To Fail banks have done to colleges what they did to the subprime housing market. If you remember, that didn’t end up so great. Maybe it’s time to strike debt.

Third year NYU law student Luke Herrine is a member of Strike Debt, where he is part of the writing team. Good morning, Luke.

Luke Herrine: Hi, Chuck. Good to be here.

CM: Great to have you on the show. Luke co-wrote the piece The Public Option for Higher Education at Dissent magazine. His colleagues at Strike Debt, economic anthropologist and UCLA assistant professor Hannah Appel and past This is Hell! guest Astra Taylor posted the TomDispatch story this week Education With a Debt Sentence: For-Profit Colleges as American Dream-Crushers and Factories of Debt.

Luke, when you were considering what education to pursue, to what degree did you consider your post-college need to pay back your student loans?

LH: Well, I went to a place where they gave me some scholarship money. But I am in a much more privileged position than most people in this country who, even if they go to a top school, are often thinking very immediately about what this means for their future. Not just whether they’re going to have an emotionally satisfying career that fulfills something in terms of ambition or spirituality or what have you, but whether they’re going to be able to get out of debt within the first decade or longer after school.

For instance, I’m surrounded by people in law school—and I think this is a familiar story—who enter law school interested in doing social justice work, and leave law school working for a firm because, you know, $80,000 to $100,000 of debt is enough to convince you to try to earn a lot of money.

CM: Yeah, definitely. Do you believe the creative class of your generation is undermined by choices that students have to make in order to pay back their student loans?

LH: There’s no question about it. For instance, just to focus on the upper tier of college education, on Ivy League schools: an astoundingly high percentage of students at Ivy League schools go into finance and banking and law. Something like forty percent of Yale’s graduating class goes into finance. And although there’s status involved, there’s no question that there’s also an element of, “look, I’m going to be in a lot of debt after this, and I need to make some money.”

In the past, a lot of those people would have gone into a whole number of different creative fields—you call them the creative class—or maybe would have taken a few years off out of college to explore a bit, to figure out what made the most sense for a career.

And that’s just the elite end of the college spectrum. It’s even more dramatic for students that go to public schools or get duped into going to a for-profit college.

CM: You write, “no doubt, there is a widespread hunger for a new way forward in education funding, and it has only sharpened in the wake of the sorry spectacle early last year of legislators squabbling over how to raise interest rates on federal loans. But the well-intentioned proposals floated by President Obama fall far short of a sustainable, effective solution to the problem.”

I would imagine that, by extension, the student loan industry, with its connections to the biggest banks, is addressed in the same way: Too Big To Fail. How devastating would it be to the U.S. banking system and to our economy if suddenly all student loans were forgiven?

LH: The first thing to realize is that a lot of the student loan industry is government-run. And although a lot of student loans are securitized and put on the bond market by groups like Sallie Mae, the federal government itself makes a lot of money from student loans. According to CBO estimates last year it made about $51 billion in profit on student loans.

So that’s important to remember. But at the same time, there’s strong reason to think that banks are making money off of student loans, both in the for-profit college industry and through the securitization process. And the increasing privatization of both private and public colleges.

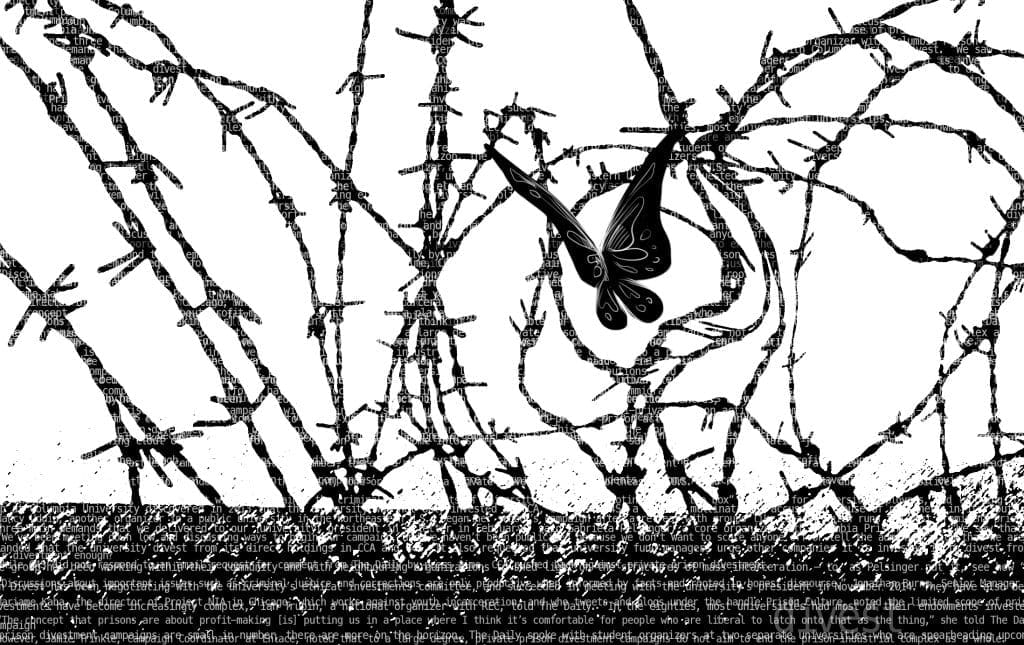

But the one reason that that question is so pressing for us at Strike Debt is that we’ve been trying to think of ways that debtors can collectively use leverage, use the amount of debt they owe together and refuse to pay it, or threaten to refuse to pay it, or pay only a small amount of it, as a way of demanding concessions from lenders, whether it be the government or banks.

And one way to know how that can be effective is to know how many people need to refuse to pay in order for the bank to actually start paying attention? There’s good reason to think that it’s not as high a number as you would imagine, because a lot of these banks are so highly leveraged.

They borrow a lot of money in order to issue loans, which means that we would only need a fraction of the number of people that you might otherwise need in order to default and make a big impact on these lenders.

CM: How much would it cost to pay for everyone who’s in a two- or four-year college? How much would it cost for their tuition for an entire year? Because if the government’s making $51 billion profit off of student loans, I just wonder if it would cost $51 billion to pay for everybody’s school.

LH: If I can recall the numbers off the top of my head, college tuition each year is in the $60 to $70 billion range. I can’t remember if that’s just public colleges or both public and private. But the fact of the matter is, the government already substantially subsidizes a lot of that amount. According to our calculations, the government would only need to add an additional $15 billion to its budget each year to fully fund all public two- and four-year colleges. That doesn’t include private two- and four-year colleges; that would be another question.

Others have estimated it would be around $40 billion a year in additional funding, which would not even approach the amount of money that the government already spends on subsidizing public colleges and private colleges. And it also subsidizes for-profit colleges, so if you eliminated for-profit colleges, you get a whole lot of profit savings.

In any case, the point is that it wouldn’t cost the government all that much to make college completely free for everybody. We heard in the news a couple days ago that Germany just banned tuition and fees at all of its universities. Chile has also already come very close to that. So it can be done, and in fact it’s affordable. It’s just a matter of political will.

CM: So do you think the reason the government hasn’t done any reforms on student loans is the fact that it makes $51 billion in profit a year?

LH: I think that’s a strong part of it. To some degree we can’t treat the government and banks and businesses as separate in this respect. For-profit colleges have huge lobbying groups; they lobby both the Department of Education and Congress. And the owners of for-profit colleges are banks. Wells Fargo has a major stake in the biggest for-profit college network, which is currently in the process of being closed down, Corinthian Colleges. Other banks have major interest in for-profit colleges, too.

But Sallie Mae also makes a whole lot of money collecting on student loans. So it lobbies Congress and the Department of Education too. And there are a whole number of other groups—hedge funds make money on student loans through fancy securitization deals, for example.

And those are the groups that have political power, so I think we can say, yeah, the Department of Education takes in all this money and the federal government takes these revenues, and certainly that is going to distort their view. If the Department of Education is operating mostly like a debt collector it’s going to think mostly like a debt collector rather than somebody that supervises an education system.

But you can’t separate out the fact that private industry is making money off of this and they have, in large part, captured the government.

CM: You write, “a fully funded system of colleges and universities is the first step towards claiming education as a vital social good. Eliminating tuition at public colleges would allow educators and policy makers to focus on what really matters: creating an educational system that benefits all of us, not just those best equipped to pay.”

But they are paying, and seemingly more than willing to. According to the AP this week, “wealthier parents have been stepping up education spending so aggressively that they are widening the nation’s wealth gap. When the recession struck in late 2007 and squeezed most family budgets, the top ten percent of earners with incomes averaging $253,146 a year went in a different direction: they doubled down on their kids’ futures. Their average education spending per child jumped 35% to $5,210 a year during the recession, compared with two preceding years, and they sustained that faster pace through the recovery. For the remaining ninety percent of households, such spending averaged about a flat $1,000. According to research by Emory University sociologist Sabino Kornrich, ‘People at the top just have so much income now that they’re easily able to spend more on their kids.’”

Has the market decided that this system can work despite it working for fewer people?

“There is not a political constituency for ‘single-payer’ college. That’s something that needs to change.”

LH: This parallels the stock market doing really well and the massive profits on Wall Street. Businesses are flush with cash, except all statistics indicate that close to a hundred percent of that money is going to rich people, the top 0.1%. Incomes have stagnated for most people, or even declined.

So this is a parallel situation. If rich people are getting richer, they’re also going to spend more on education, because what keeps you in the top 1%? Well, partially, education.

So it depends on what you mean by the markets “working.” The market is working for the top 1%, but it’s not working for most people. That’s not a sustainable way to do things, moving forward. I mean if you have private colleges serving only people that can afford them, they’re going to cater to those people. There are more and more colleges investing in big luxury goods rather than scholarships or accessibility initiatives.

So we’re going to get a majorly distorted system, with multiple tiers of education—which we already have, to a large degree —and it’s not a way to keep an economic system working. We need educated people both to keep an economy moving forward and also to keep a government working. If you’re running a “democratic” government, you need people who actually know how to think about these issues to contribute to the political process.

CM: You write, “Obama also proposes to universalize income-based repayment. This would at best by a palliative. Monthly payments would be lower, but they could endure for much longer, accruing more interest and leaving the poorer students on the hook for the largest amounts of debt service. All in all, the president’s version of higher education reform is as needlessly complex as Obamacare, and moves us further away from the goal of a democratic educational commons.”

But the original intent of what would become the Affordable Care Act was universal coverage that lowers costs for everyone. But Senator Max Baucus, who ran the committee to create the legislation, said early on that single payer was off the table, and many believe that what we did end up with is the only and best thing we can get, considering how our government operates, how anti-healthcare the Republicans were, and the power of private interests.

Do you believe, then, that Obamacare in the education system is the best we should expect? And would Obamacare-style education be worse than Obamacare?

LH: Whether it’s the best we should expect or not depends on how our expectations have been calibrated. I think given the current state of Congress and the current state of the Democratic Party, it probably is the best we should reasonably expect. But one of things that we’re trying to do is bring people together to change the political landscape, to shift the Overton Window such that it’s not the best that we can expect.

So whereas in the Affordable Care Act debate, single-payer healthcare and even a public option were at least thought of as possibilities in the beginning, in the higher education debate we certainly don’t hear politicians talking about free higher education.

So while there is a political constituency for single-payer healthcare, there is not a political constituency in the same way for single-payer college. That’s something that needs to change. Even when that does change, it doesn’t guarantee that we’ll get what we want, but it will change the debate, shift it towards talking about education as a human right and something that should be provided in an accessible way.

“For-profit colleges are basically just scam institutions that feed on the systemic failure to provide higher education to poor people.”

CM: You write that “President Obama’s and Oregon U.S. Senator Jeff Merkley’s solutions are slightly more humane than the current system, which has seen tuition costs almost sextupling since 1985. They are a preferable variation of Milton Friedman’s model of ‘human capital contracts’ now being put into practice by ex-Citigroup CEO Vikram Pandit and other startup entrepreneurs looking to pay for students’ education in return for a percentage of their future earnings. But the embrace of these plans by some progressives reveals how diminished our political imagination has become.”

Yet again, it looks like we have a lack of solutions from the Left. But you do have a solution, except your solution—public funding, at the cost of $12.4 billion a year—is too radical for progressives. What does a lack of a solution from the Left, and their unwillingness to embrace the idea of education as a human right—what does that say to you about today’s liberals?

LH: There are hundreds of people in the halls of Congress that work for banks, for-profit colleges, and student loan servicers lobbying and getting in congresspeoples’ ears about how important it is to increase student indebtedness (although they don’t put it in those terms). But there isn’t a mobilized group of people talking about how important higher education is and how easy it could be to fund it in a sustainable way.

So to some degree it’s misleading to point to politicians and say, “look how limited their imagination is!” Their imagination is limited because the political process is so overwhelmingly skewed in favor of the interests of the 1% and Wall Street. And there’s complicated reasons for that. But the point is that we citizens, we on the Left, and even those who aren’t on the Left who might think that higher education is a good idea—and I think there’s a substantial amount of people who would not consider themselves on the Left that would agree with that idea—need to organize, need to make it a political issue, and need to come together. This would substantially change the way we talk about not only education but a whole number of other social goods that are currently debt-funded.

CM: I want to ask you about the TomDispatch.com story a little bit, because its authors have this great term, “subprime education.” Hannah and Astra write, “imagine corporations that intentionally target low-income single mothers as ideal customers. Imagine that these same companies claim to sell tickets to the American Dream: gainful employment, the chance for a middle class life. Imagine that the fine print on those tickets, once purchased, reveals them to be little more than debt contracts profitable to the corporation’s investors but disastrous for its customers. And imagine that these corporations receive tens of billions of dollars in taxpayer subsidies to do this dirty work. Now, know that these corporations actually exist and are universities.”

Has this made universities more profitable, or are these the things they are forced to do to just get by because of a lack of federal funding?

LH: It’s important to separate for-profit colleges from other universities, but there is some continuity. There has been a massive decrease in state and federal funding of higher education over the past thirty years which has caused all universities—public, private, and for-profit—to look elsewhere for funding. Now we are seeing universities with very rich people on the board of trustees making decisions about what professors can say, which professors can be hired, and at what low salaries, because that’s the only way these universities can get money, by taking those donations.

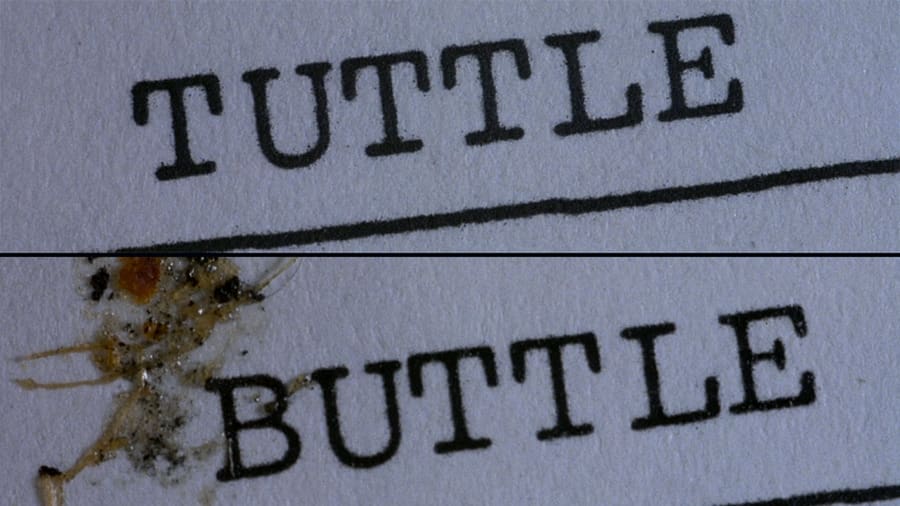

But there is also this general inability to provide higher education for the least well-off people in our society—that’s poor people, primarily poor people of color. For-profit colleges saw a business opportunity there, came in to fill in the gap, and they’re totally legal. They do a whole bunch of illegal things, but the federal government provides close to ninety percent of the funding for most for-profit colleges through federal student loans. That’s where they get most of their money from.

Some of them started out actually providing somewhat quality education, but for the most part they are all now scams. Almost unqualifiedly. They tell students, “look, we’ll train you for the job that you need,” and then most of the students drop out; those that make it through are put in internship programs where they’re not paid, with the promise that they might get a job afterwards. And then they are not given a job. Most students that go to for-profit colleges don’t get a job in the field in which they studied. And a lot of the teachers, the “professors” there, don’t even know the field that they’re teaching.

These are basically just scam institutions that feed on the systemic failure to provide higher education to poor people.

“Just as it’s impossible for a worker to conduct a strike without the rest of her coworkers joining her, it’s not possible for debtors to resist the structural mechanisms that put them in debt simply by individuals refusing to pay. It has to be a collective action.”

CM: It seems like what they’re doing is exploiting the most vulnerable. Luckily the most vulnerable are politically disenfranchised. So how difficult is it to make this an election issue?

LH: I think the question answers itself, doesn’t it?

CM: Yeah, I think it does too.

So you write about how President Obama has even “spoken out against instances where for-profit colleges preyed upon troops with brain damage. These Marines had injuries so severe some of them couldn’t recall what courses the recruiter had signed them up for.” So these for-profit schools are also taking advantage of the troops that we’re supposed to be supporting.

Why didn’t that cause an uproar and make people think about reforming the for-profit college system? And can we just put the cat back in the bag?

LH: I should point out that one of the reasons for-profit colleges recruit veterans so vigorously is that for-profit colleges are required to get at least ten percent of their funding from somewhere other than the Department of Education. As I said before, most for-profit colleges get most of their funding from student loans from the Department of Education. Well, what’s one way to get around that? Get student loans from the Department of Defense, through the GI Bill! The Department of Defense also issues student loans, but that is not counted towards the ninety percent cap that these for-profit colleges are limited by.

Why that hasn’t become a bigger issue, politically, is for much the same reason that a lot of mistreatment of veterans is ignored. That is: most of them are poor and politically disenfranchised. A lot of people enter the military because they have no other good financial options, and they feel like they want to contribute to society in this very significant and self-sacrificial way.

So although it’s quite easy to make a political point about how important it is to respect the troops, it’s much more difficult to actually spend money and resources on it. And although the Department of Defense has moved some small steps in the direction of actually monitoring for-profit colleges, the overall political will is simply not there because it involves addressing issues of poverty, race, and the failures of public provision of higher education.

CM: At the StrikeDebt.org site, the first thing you see are the words “You Are Not A Loan.” But as of right now, we are all loans, whoever is in indebted for their education. Your group is a group of debt resisters, and I want to join right now because I have been refusing to pay back one penny of my now over $120,000 in student loans. I refuse to pay them back. I graduated eighteen years ago. I think it’s completely immoral. But neither of us can resist paying back that debt. Resistance is futile, because if I ever make any money and they find out, I’ll be forced to repay.

How much of a debt resister can anyone be?

LH: Just in the same way that it’s impossible to be a labor union without a union, without a collective—it’s impossible for a worker to conduct a strike without the rest of her workers joining her—it’s not possible for debt resisters to resist the structural mechanisms that put them in debt simply by individuals refusing to pay. It has to be a collective action.

And that can start in a number of ways. As you say, a lot of people are already unable to pay their loans, and refuse to pay those loans. But if those people who are already at that point, and are ready to take that risk, come together and do so with a collective voice, that’s very different from each of them individually dealing with the consequences.

This is why we want to emphasize that people are not alone. Because even though they are currently feeling isolated, they are in the same situation as a whole number of people. And if they come together—and we are currently creating an online platform called DebtCollective.org, which we encourage people to visit—if those people come together on that platform or another, debt resistance can become much more powerful and less isolating.

At the same time, we are working with Corinthian College students, not necessarily to refuse paying—although we’re thinking about a number of different strategies—but to come together and find a collective voice to get their debts discharged. There are a number of legal mechanisms in place that would allow them to do so, that the Department of Education is currently cutting off.

For those student debtors in that narrow class to come together and find a collective voice, and to put pressure on the institutions that create student debt to relieve them of their debt, would be a major victory and it would be a way of creating momentum towards more debtors uniting.

And we don’t think this should end with student debt. There’s a whole number of different types of debt that people could unite in refusing to pay and renegotiating. There’s currently a potential that’s very untapped.

CM: You guys have actually done some work where you have had people’s loans taken care of. What did you do in order to alleviate some people of their debt burden?

LH: The initiative you’re referring to we called the Rolling Jubilee. A “jubilee” is this ancient tradition of forgiving debt periodically. We are modernizing that tradition by taking advantage of this thing called the secondary debt market. When lenders think they’re not going to be able to collect on a debt, they sell that debt on the secondary market, for pennies on the dollar, literally—one to five cents on the dollar—to cut their losses, and then debt collectors go out and hound people for their debts.

What we did in the Rolling Jubilee is we entered that market and bought some debt—we’ve done this a couple times, now—and rather than hounding people for it, we’ve sent them letters telling them that it’s been released. We cancelled it.

So far we’ve forgiven about $18 million of debt; that includes about $14.5 million of medical debt, and about $3.8 million of student debt—Corinthian College debt specifically.

CM: Wow. Congratulations, sir.

How do I get involved?

LH: We see the Rolling Jubilee as primarily a way of sparking the imagination, making people realize that there are ways that ordinary people—we’re all ordinary people, none of us are debt collectors or specialists—can intervene in collective ways to make the world better, and to open people’s minds.

At the same time it’s a way for sparking people’s imagination towards what collective resistance could be. We have a couple more debt buys, but we’re moving towards closing down the Rolling Jubilee and moving towards something that you can join, which is the Debt Collective.

Right now, what we’re doing is collecting names and email addresses and forming a base where people can find other debtors and start to think about what it would mean to resist one’s debt collectively. So DebtCollective.org is the place to go.

The other thing you can do is go to StrikeDebt.org, download the Debt Resister’s Operations Manual, which is a book that we put together on how debt works in different areas, and different ways to resist it both on your own and by forming small collectives.

And we encourage people to be creative. You don’t have to join us, necessarily, to find new ways to resist debt and to change the way people think about their own financial situations.

CM: Luke, it’s been great having you on the show. This has been a fantastic conversation. I hope that there’s a whole bunch of students who are listening or people who are in debt that will go to the Strike Debt and Debt Collective websites. You guys are doing really, really fantastic work. You should be very proud of what you’re doing. Thanks so much for being on the air and the best of luck with your campaign.

LH: Thanks, Chuck, and thanks for taking so much time to talk about this stuff.

Pingback: You Are Not A Loan | Occupy Wall Street by Platlee