Transcribed from the 12 March 2016 episode of This is Hell! Radio and printed with permission. Edited for space and readability. Listen to the whole interview:

We’ve got to have a different concept of wealth. Wealth isn’t the accumulation of money. You can accumulate money by issuing it to yourself, as the private sector has done. Wealth is the capacity to produce the goods and services we need. Wealth is personal security, not financial security.

Chuck Mertz: Did you know that an economy could be democratic? Yeah, I didn’t know that either. I always assumed that we live under the dictatorship of the dollar, the euro, or whatever we use for money, and there is no alternative. Here to tell us why our economy is not democratic, what economic democracy looks like, and how we can get there, social scientist Mary Mellor is author of Debt or Democracy? Public Money for Sustainability and Social Justice.

Welcome to the show, Mary.

Mary Mellor: Glad to be here, thank you for inviting me.

CM: In your book you quote Martin Wolf, the chief economics commentator at London’s Financial Times, writing in 2014: “A system that is based on the ability of profit-seeking institutions to create money as a byproduct of often grotesquely irresponsible lending is irretrievably unstable. Ordinary taxpayers are being forced to suffer in order to save a banking system that has brought them only excess and ruin. This is intolerable—indeed, a form of debt slavery. No industry should have the capacity to inflict economic costs that may even surpass those of a world war.”

But Mary, is it possible to stop something, no matter how irresponsible, given today’s economic climate, no matter how damaging it is to taxpayers, or even to the environment? Is it possible to stop that thing, as long as a profit is being made?

MM: Quite the opposite from stopping it, we actually started it—and saved it, with the public response to the financial crisis. We don’t need that system. That system needs us, the public, and the use of public money.

Money has not been seen as a political issue by left or right. It’s just a given. It’s something that exists in society; we all know it, we all use it. But we don’t really understand it. The aim of my book was to reveal what money is, how money works, how money has been privatized in modern capitalist economies, and how we can rescue and democratize that money in order to create a more socially just and sustainable society.

CM: What explains that disconnect? We use money each and every day. We live in a capitalist society. We use money; we understand our place within the economy; but we don’t understand money.

MM: We don’t ask the key questions. Where does money come from? Who controls it? Who issues it? What is its form? We don’t ask these questions. We just assume that it’s a given.

Money doesn’t come from nowhere. Money has to be created, it has to be circulated, it has to be managed. That is quintessentially a public function, it’s not a private function. But we have failed to see the importance of the public function. Perhaps Keynes was the last major economist really to put money at the center of his thinking. Because we don’t ask fundamental questions about money, we don’t understand the political capacity and the political opportunity.

In 2008, financial capitalism was on its knees. And Gordon Brown, the British chancellor at the time, stepped in at the G20 and whipped up the response of the public sector across the globe, to save capitalism from itself. That has never been acknowledged. Instead, the public sector has been berated and punished by austerity, for having got itself into debt through its rescue.

It didn’t need to get itself into debt. It created the money that saved the financial sector. It didn’t have to deem that to be debt. The public money system, public monetary authorities, have the perfect right to create money and issue money. That is what we have to rescue. That right has to be rescued, and it has to be democratized.

CM: You write, “Proposals seeking to achieve environmental sustainability, social justice, or other progressive policies are rejected by the implication that money is in short supply. Public expenditure is presented as zero-sum. Somebody has to pay. Any public expenditure must therefore be at the expense of the individualized taxpayer or private wealth creators, who are assumed to be reluctant to part with their money. Public expenditure, then, becomes politically problematic.

“However, public expenditure need not be zero-sum. Public money is not in short supply. The outpourings of new money to meet the financial crisis did not have a bottom line. The head of the European Central Bank declared he would ‘do what it takes.’ Why did the banking sector trigger such largesse while the poor and vulnerable and the planet did not? While the people were subject to austerity, the financial sector quickly got the bonus culture rolling again.”

Again, I want to repeat this one line. “Public expenditure need not be zero-sum.” I think a lot of people believe it is. Why doesn’t it need to be zero-sum? Doesn’t spending on war take away money from helping the poor or fighting climate change? Why isn’t all money, in every instance, zero-sum? Doesn’t paying for one thing take away from another?

MM: I point to four myths, and a confusion in the understanding of money. One of the main myths is the “scarcity” of money. This relates back to the association of money, originally, with precious metal, which was obviously in short supply. Now, this is a complete misunderstanding of what money is. It implies that money has a value in itself, and somehow people have to compete for the use of it. But that’s only because precious metal money has survived historically, whereas other much more used forms of money—it could be paper, sticks, stones—don’t survive in the same way.

We’ve got this mythology that somehow there is a shortage of money, because money is a commodity and we have to compete for it, but that isn’t what money is. Money represents relationships. In a sense, a payment in money terms is a token that acknowledges that you’ve done certain things and that you require certain things. You get your wages and then you have to pay your bills and buy your food, etcetera.

There’s no shortage. Money is just numbers. It’s just paper. Even the illusion that it had anything to do with precious metals has been gone since the 1970s, and that was an illusion anyway. So really there is as much money as we want to have relationships, as we want to have activities, as we want to care for each other, as we want to care for nature—or, as through most of history, if we want to fight ridiculous wars.

Now, we have to be careful: there is no shortage of money, but there can be such a thing as too much money. That is the other end. There’s no shortage of how many numbers and how many bits of paper we can circulate. But if we circulate more than we have actual activity, then we will get inflationary pressures.

So you’ve got as much money as you want for the activities you want, but you mustn’t issue and circulate money beyond the level of activities you want. It’s quite a delicate balance. But it isn’t a problem of a shortage of money.

The crisis of 2008 was really a crisis of money. It was a crisis of the privatization of the public capacity to create currency. And if it was a crisis of money—that is, a public currency that is issued in the public’s name—then we as the public have to rise up and take control and say we want to use our money for ourselves, for our public purposes, and the market must serve us rather than us serving the market.

CM: Speaking of too much money, you write about the bank bailouts: “By 2009, US government and central bank action had totaled $10.5 trillion, and by 2012 the US Federal Reserve could have allocated as much as $29 trillion in loans and various other forms of support to the US banking sector. This is nearly twice US GDP. Britain and Ireland had to offer similar levels of support to steady their banking and financial sectors. Ireland in particular guaranteed all bank deposits.”

Then you cite macroeconomist and fund manager Felix Martin suggesting that the “crisis overall may end up costing more than three times global GDP.”

Yet every time I hear about the bank bailouts, I’m told that they were a massive success for the taxpayer. For instance there’s this from Pro Publica last week: “Altogether, accounting for both the TARP and the Fannie and Freddie bailout, $618 billion has gone out the door, invested, loaned, or paid out, while $390 billion has been returned. However, the Treasury has been earning a return on most of the money invested or loaned. So far it has earned $294 billion. When those revenues are taken into account, the government has realized a $65.3 billion profit, as of 2 March 2016.”

How can the government both make money off the bailouts and simultaneously the deficit greatly increases “due to banking actions”? What isn’t considered in the bailout expenditures within conventional economic thinking?

MM: Public money goes in a circuit. We issue public money—in this case to save the banks—by the central bank or by the treasury, which both helped to bail out the financial sector. I’m not at all surprised it came back, because it put a lot more money back into the system than had disappeared.

The trouble is that any excess of public expenditure over that brought in by taxation is deemed to be a borrowing by the public, whereas in fact it’s not a borrowing, it’s a creation. This makes it look is as if somehow the public sector borrowed all that money for the rescue, and therefore it hasn’t offset more than a part of it. But if we say that money was created and circulated, which in fact it was, then obviously there’s no cost on the public for issuing it. Anything it gets back becomes a benefit.

It’s a question of what we deem this public money creation and circulation to be. That’s why I talk about debt or democracy. It’s whether we see it as money issued that somehow the public sector has “borrowed” off somebody.

In fact, the irony is that this money is deemed “borrowed” off the very people it was rescuing, the bankers, because the money issued is then sold as a product to the financial sector: the state issues a lot of money to save the financial sector; it then issues debt instruments which allow the financial sector, which has been given all this money, to buy the debt that in fact represents the money they’ve been given. So the ironies just build on top of each other.

CM: That is amazing.

You write, “This right to create the public currency descends from the autocratic powers of rulers. The question is, why has it come to rest with central banks rather than with states more generally? More importantly, how has this power been made available to the banking sector and not the people?”

My understanding is that central banks are independent of governments in order for them not to be influenced by the political agenda of elected leaders. Does that independence from government explain why they prioritized the concerns of banks over the concerns of people? And how dangerous would it be if we did have political control over those banks, if they weren’t independent?

MM: The independence, as you say, is to make it so the banks can use the public prerogative of creating money out of nothing, to use this public authority to create money entirely to support the privatized banking system, which issues money only as debt. It puts the public sector itself (which has the prerogative, historically—although not democratically; autocratically—to create money) into the debt of the financial sector. So the state itself, which has the prerogative to create money, is deemed to be in the position of having to borrow what is in fact a public right. That is, the right to create money.

Felix Martin called it the “great historic compromise” when the central banks were set up. He says that historically, the rulers were in control of money—particularly coinage, but also other forms of money—and they created and circulated money. The private financial sector couldn’t create public currency, because that was a prerogative of the ruler. But they created a whole banking system which was based upon public relationships of trust and credit. Private loans. Private arrangements. Private promises. It was never based on gold deposits and things like that

When the monarchs ran out of capacity to tax their subjects—who were in fact the same people, the rich people they were trying to borrow money off—they ended up borrowing private credit off the commercial sector to help fund wars, etcetera, which is how the Bank of England first started up. But the trouble is, those private banks, over time, weren’t very stable. They each issued their own form of notes, and they often went bust. So eventually those banks designated all their lending in the national currency, in public bank notes.

The compromise Martin is talking about is: in order to get access to commercially created money, over time the state gave its prerogative of creating public currency to the private banking system. When a bank lends you the money to buy a house, it doesn’t lend you, I don’t know, “citibank dollars.” It issues federal dollars. It issues you national currency. Although it is in fact a loan from Citibank, you’re not borrowing from the public as such, but it’s designated as the national dollar. Therefore, the nation itself has to guarantee that money which is issued in its name.

This is the trick of how commercial banking became locked into the issue of the public currency. The public sector, the rulers, lost control of the ability to create money, and even—under neoliberalism—the right to create money. That phrase that we hear over and over again: the state must not print money! The state must not print money! Well, it can print money. And it has printed money. What we’ve got to do is say, if we can print money, can we not print it for the benefit of the people?

What about the potential misuse of it? Public rulers did abuse the system, undoubtedly. But then private bank owners abused the system as well, and issued money to themselves for their own purposes, the same way rulers issued money to themselves for their own purposes. The whole point of democratic money is that it should be open and transparent and accountable, and should be determined by the people, in their name, to provide services to themselves. However much money they need or want to have in society would represent how much services they want to provide to themselves, because that would be the function of money in a sustainable and socially just system.

CM: As you point out in your book, there’s this idea of TINA, that There Is No Alternative. And when we were talking about the bailouts in the mainstream media here in the United States, it seemed like there was no alternative to bailing out the banks.

You are pointing out that there is an alternative. Is the perceived lack of an alternative simply because we are being taught misleading conventional economics through private interests, through our government, and through the media?

I wrote the book to give the people representing the 99% the analysis and the concepts and the courage to claim the right of the people to its own money and to its own economy, and to democratize the money system. A lot of people talk about abandoning it, saying money is the root of all evil. No, money is potentially a public good. We just have to harness it.

MM: Absolutely. We are completely ignorant about the money system. We defer entirely to the banking sector and the banks’ right to create money, and we don’t have any sense of the power the public should have.

And it’s not just that. Radical groups have the incredible opportunity to challenge the ideology of neoliberalism—that states cannot create money and that markets are efficient, etcetera. There was a wonderful moment there to really capture the high political ground for the public sector and the public economy.

But we have bowed under to the ideology of what I call “handbag economics” for so many decades now that people just didn’t have the words. It was a tyranny of ideology. They didn’t have the words, they didn’t have the concepts. Even radical thinkers just didn’t have the grasp to make the challenge. We could have changed the nature of the debate. We had all the critique about the 99% and the 1%. The critique was there. It was tipping on the edge. But there wasn’t a politics, there wasn’t an alternative.

The alternative was staring us in the face. The alternative was that the private sector cannot run without public money and public governance, and the ability to tap into this sovereign power which the people have—to create money free of debt. That is fueling the financial sector and enabling it to convert all this money into loans and therefore earning profit and feeding up to the next crisis.

That’s why I wrote the book. I wrote the book to give the critics, the people representing the 99%, the analysis and the concepts and the courage to claim the right of the people to its own money and to its own economy, and to use the money system, to democratize the money system.

A lot of people talk about abandoning it, saying money is the root of all evil. No, money is potentially a public good; it’s potentially a public source. We just have to harness it. We just have to have the courage of asserting the right of the sovereign people to use the circulation of money to serve themselves.

I don’t use the word “economy,” because economy is all about profit. I use the word “provisioning.” We must provision ourselves. We would use the circulation of money to provision ourselves with the goods and services we need. We don’t need the market. The market needs the public. It’s not the public that’s parasitic on the market, as handbag economics has it, that the public is the housewife and it’s got to cut expenses, tighten the belt. We don’t have to do this. We don’t. We’re not dependent on them. They are dependent on us.

Every time the system goes into crisis, it relies on the public capacity to create public money free of debt to reinflate the balloon. We’ve just got to have the confidence to get a hold of this analysis and say enough, no more. I want to build people’s confidence. I want to say there is an alternative, and it’s here. It’s been used. It was used blatantly in 2008 and the years afterwards. And we haven’t built politically on it.

CM: I want to talk about “wealth creation” in a different sense, because it is such a narrative here within the US.

You write, “Money is assumed to appear in the economy as commercial necessity demands, that economic activity somehow creates money. This presupposition leads to the assumption that having money is evidence of having created some form of economic value. The rich deserve their wealth because they must have done something to have earned it.

“The benign view of the rich would be very different if they were known to be directly or indirectly able to simply create that money. In reality, rather than competing for a fixed stock of money where the winner is assumed to have been the most effective, efficient, or productive, the wealthy have merely expanded the money supply with themselves as beneficiaries.”

How is that different from earning and deserving money through an innovative genius that creates profits?

MM: That’s what I’m saying. This is because we have economies rather than provisioning. Economies are defined by what makes a profit, rather than the benefit of goods and services. The assumption is that making a profit somehow automatically produces goods and services people want. This was the promise of capitalism. It was going to be capitalism for everybody. It was going to spread wealth, it was going spread opportunity, and it would be the best of all possible worlds.

Now we know that this isn’t true. We know that, particularly under finance capital, it’s growing more and more unequal, and the wealthy are just lining their own pockets and not providing goods and services; they’re not providing good jobs.

That’s why I changed the word to provisioning as a word for the public economy. It’s the schools, it’s the health service, it’s transport systems, it’s infrastructure. It’s what people have built over time to service each other. So if we ask what can best meet people’s needs, I think public economy based on democratic money is more likely than capitalism to be successful as a provisioning system.

We’re asking the wrong questions of capitalists. We ask, can you make a profit? Is this profitable for you? Instead of asking: what of this is benefiting us? Where are the goods and services for us? Where is the provisioning for us?

We’ve got to have a different concept of wealth. Wealth isn’t the accumulation of money. You can accumulate money by issuing it to yourself, as the private sector has done. Wealth is the capacity to produce the goods and services we need. That is what wealth is. Wealth is personal security, not financial security. It’s knowing that the goods and services you want will be there when you need them.

CM: Mary, I’ve got one last question for you, and as we do with all our guests, our final question is what we call the Question from Hell, the question we hate to ask, you might hate to answer, or our audience is going to hate your response.

Why have we allowed the sanctity of debt to trump the sanctity of our planet?

MM: Because we were kept in ignorance. And because neoliberal capitalism has a very strong-seeming ideological framework that seems, superficially, to make sense. The best people were doing the best job and making the most money. What was wrong with that?

What we’ve done is privatize the public potential of money over time into the private banking system—this is merely a stage of capitalism; the next stage is to democratize that system. Its main engine is this capacity to make and create money and issue it to itself. It’s a hidden thing. It’s something most people don’t realize.

But I’m quite optimistic, because I’m not the only person saying this. There are lots of people coming to the same conclusion, that the crisis of 2008 was really a crisis of money. It was a crisis of the privatization of the public capacity to create currency. And if it was a crisis of money—that is, a public currency that is issued in the public’s name—then we as the public have to rise up and take control and say we want to use our money for ourselves, for our public purposes, and the market must serve us rather than us serving the market.

I’m quite optimistic that we have a moment here. We’ve taken a while to get around to it, but I’m quite optimistic that if people grasp these ideas, then they will be so angry that they will rise up. And they will not just rise up complaining about the system; they will rise up saying that there is an alternative. The alternative is public money for public economy for public purposes, democratic, accountable, and open. That is what we should be campaigning for.

I’ve got proposals in my book for how we would democratize money and how we would establish national budgets and how we would monitor and be accountable. One of the things I would want to do is create an income to nature, not take an income from nature the way we’ve exploited it, but provide an allocation of money to nature, to preserve it and to enable people to live within the capacity of nature. Just like we can provide money for health services and care services and for all the things we need, I think nature has to be a recipient as well.

CM: Thank you very much, Mary, it’s been an honor and pleasure having you on the show this week.

MM: Thank you for giving me the opportunity.

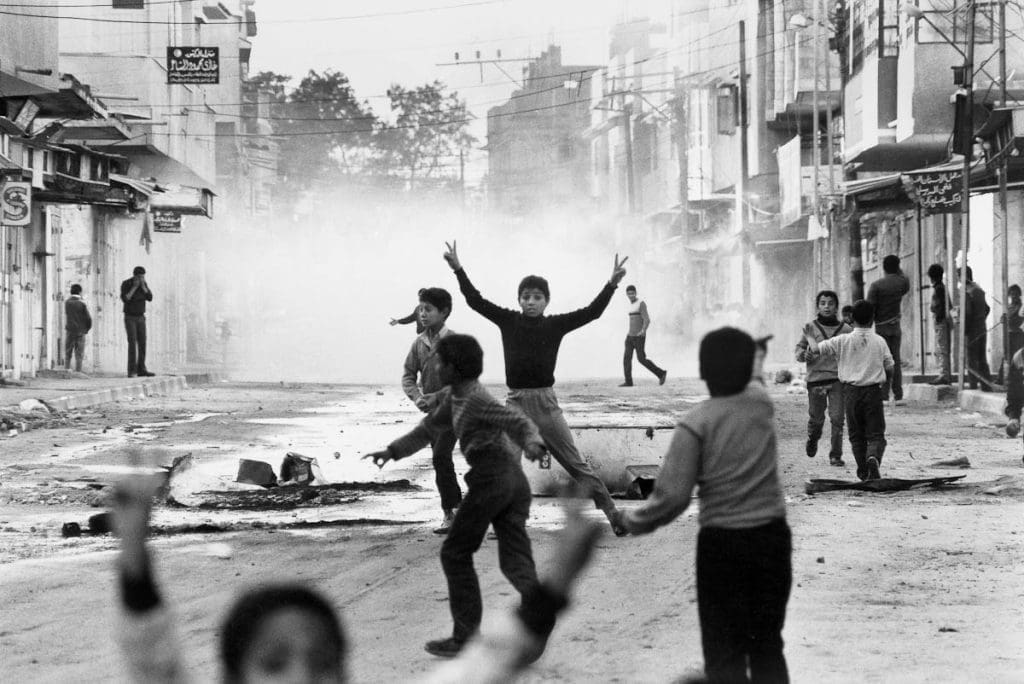

Featured image source: Street Against